The mini electoral budget: new major GTA highways and staycation tax credit pledged

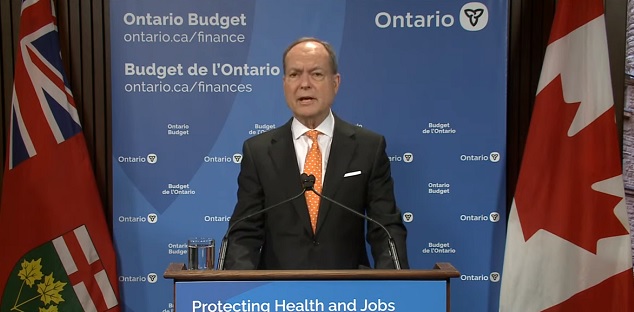

TORONTO – The provincial government is preparing for the 2022 elections, seven months in advance. Today, Finance Minister Peter Bethlenfalvy introduced the Fall Economic Statement, a document that usually has a lesser value and that lays the foundations for the Spring Maneuver. We are in the presence of a real mini budget, with a detailed spending and investment plan, a clear indication of the government’s willingness to arrive at the next electoral consultation with a well-defined economic and fiscal platform. In the document, first of all, an increase in the deficit of 5.1 billion dollars is expected: the budget red, for the fiscal year 2021-2022, should reach 21.5 billion.

Compared to what was budgeted by the last Provincial Budget, the planned expenses increase by 3 billion dollars, with sustained growth in the health sector, in home care, in appropriations for long-term care homes, and with the first but significant appropriations in infrastructure discussed in recent months.

In this year’s Fall Economic Statement, in fact, comes the confirmation that the provincial government will go ahead with its plan to build Highway 413, a stretch of highway that will connect Vaughan to Milton and that in the past has been at the center of a strong controversy due to the environmental impact that the construction of the highway will produce.

Green light also to the Bradford Bypass, a link from East to West between Highway 400 and Highway 404: the first expenditure for these two projects, which are still in the embryonic phase, and which are strongly contested, has been quantified at 1.6 billion dollars. The document also provides broad forecasts of our economy and the possible return of the budget hole.

According to Bethlenfalvy, in the fiscal year 2022-2023 the provincial deficit should fall to 19.6 billion dollars, while in the following year, thanks to an expected post-pandemic economic recovery, the red should fall to 12.9 billion dollars. Provincial gross domestic product is expected to grow by 4.3 percent in 2021, 4.5 percent next year and 2.6 percent in 2023.

In the Fall Economic Statement there is also a measure that has so much the flavor of electoral measure, developed to captivate the electorate next year.

This is the Ontario Staycation Tax Credit, which will cost about $ 270 million: basically, it is the possibility of tax exemption up to 20 percent of the cost – and for a maximum of a thousand dollars per person or $ 2 thousand per family – for holidays spent in any tourist resort in Ontario, including hotels, motels, cottages, bed and breakfasts and campsites.

In the other items of expenditure contained in the mini budget we find 80 million dollars for renovations in the homes of pensioners and 345 million dollars that will be distributed to the various municipalities to meet the expenses of public transport, which are still suffering from the crisis caused by Covid.

The government then budgeted an additional $541 million for the health sector over the next three years, particularly for the recruitment of nurses and PSWs in hospitals and long-term care homes.

Compared to what is foreseen in the 2021 budget, the government has decided to cut spending on education by 360 million dollars. The Fall Economic Statement also includes the already announced increase in the minimum wage to $15 per hour.