Trudeau offers ‘discounts’. Blanchet: “He’s buying votes”

TORONTO – Prime Minister Justin Trudeau, in “free fall” in the polls, is playing the pre-Christmas “tax break” card: a two-month suspension of the Goods and Services Tax (GST) and the HST (Harmonized Sales Tax, a harmonized sales tax that is charged only in some provinces of Canada) on basic necessities, children’s clothing and diapers but also restaurants, beer and wine, as well as numerous other products. Not only that: at the beginning of Spring 2025, all Canadians who worked in 2023 and earned up to $150,000 after taxes will receive a “bonus” of $250.

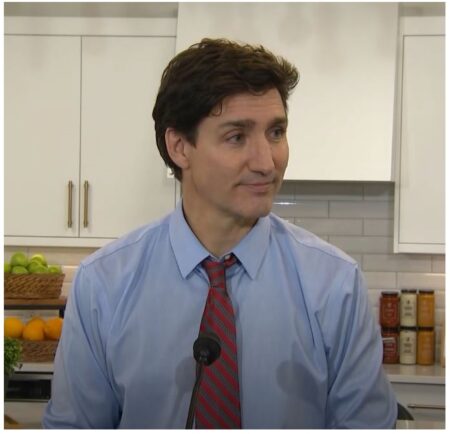

The prime minister himself made the announcement, together with his deputy Chrystia Freeland, yesterday, in a “Vinces” grocery store (an Italian-Canadian company), in Sharon, Ontario, where he was visiting. On the occasion, Trudeau and Freeland also announced a “bonus”: the “Working Canadians Rebate” will send a payment of $250 to 18.7 million Canadians in early spring 2025. They will be entitled to the “one-off” $250 all Canadians who worked in 2023 and earned up to $150,000 after taxes. The money will be sent by the Canada Revenue Agency, via direct deposit or cheque (all details are here).

But let’s go back to the “discounts” and see which consumer goods the federal government will offer relief on between 14 December and 15 February (you can find the complete list, with all the details, here).

- Prepared foods, including vegetable trays, pre-made meals and salads, and sandwiches.

- Restaurant meals, whether dine-in, takeout, or delivery.

- Snacks, including chips, candy, and granola bars.

- Beer, wine, cider, and pre-mixed alcoholic beverages below 7 per cent ABV.

- Children’s clothing and footwear, car seats, and diapers.

- Children’s toys, such as board games, dolls, and video game consoles.

- Books, print newspapers, and puzzles for all ages.

- Christmas trees.

According to the federal government, the tax cut will cost $1.6 billion and save, over a two-month period, $100 for a family that spends $2,000 on goods.

Reactions to this federal government’s initiative were varied: the leader of the Conservatives, Pierre Poilievre, branded it as useless, stating that “the two-month GST holiday on a select number of goods will do nothing to make making life more accessible to Canadian workers”.

The leader of the Bloc Quebecois, Yves-F. Blanchet, said he is “strongly against” Trudeau’s initiative. “I am clearly against the idea of the government giving money to Canadians to try to get votes” he said, noting that the government has not found the money to increase seniors’ pensions as Bloc proposed, but the same government will give 250 dollars each to those who earn up to 150 thousand dollars” (wasn’t it better to give those 250 dollars to those who earn nothing?) “…give the money to those who already have it, it’s a measure that makes no sense”, underlined Blanchet.

The leader of the NDP, Jagmeet Singh, has an opposite opinion on Trudeau’s initiative, to the point of appropriating it, arguing that Trudeau’s Liberals have simply succumbed, albeit in part, to the NDP campaign called “Tax-Free -Essentials”: Singh’s party had in fact promised the elimination of the GST on basic necessities (but also on monthly bills, not included in the “relief” announced by Trudeau).

“NDP gives Canadians winter tax holiday. The Prime Minister’s office just informed us that they are giving in to our Tax-Free-Essentials campaign – in part,” Singh said, announcing that the NDP “will vote for this measure because workers desperately need help and we are proud to have done something for them again”.

This time too, therefore, Trudeau’s minority government, which officially no longer has the support of the NDP, will be able to enjoy Singh’s “crutch”. And carry on a little longer.

In the pic above, Prime Minister Justin Trudeau today at “Vinces” during the announcement (screenshot from the video on the www.cpac.ca channel)